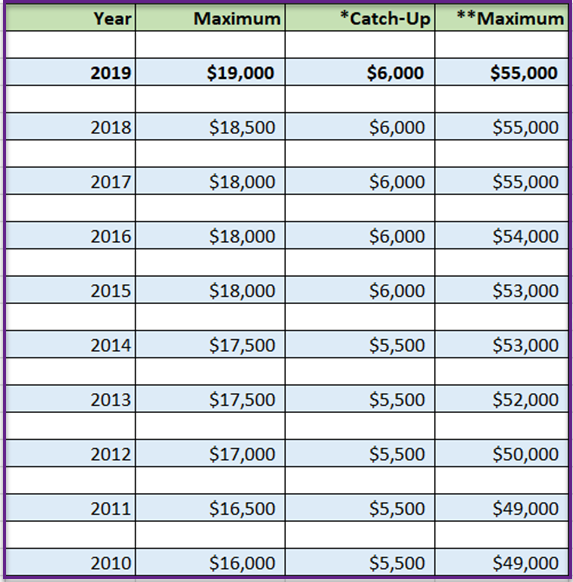

Irs Maximum 401k Catch Up Contribution 2025. The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2024. But, for individuals ages 60.

In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2024. In 2025, the total contribution limit is projected to be $71,000.

Irs Maximum 401k Catch Up Contribution 2025 Images References :

Source: florriyjacquie-chi.pages.dev

Source: florriyjacquie-chi.pages.dev

Maximum 401k Contribution 2025 Catch Up Gaynor Gilligan, In particular, participants can now elect to defer up to $23,500 to 401 (k), 403 (b), and.

Source: elieasebathsheba.pages.dev

Source: elieasebathsheba.pages.dev

401k 2025 Contribution Limit Catch Up Agatha Lyndsey, Employee contribution limits go up $500 more in 2025, to $23,500 from $23,000.

Source: noellasemilicent.pages.dev

Source: noellasemilicent.pages.dev

2025 401k Maximum Contribution Over 55 Faunie Darleen, So, these taxpayers can still contribute an additional $7,500 in 2025 ($31,000 total).

Source: rorieymartha.pages.dev

Source: rorieymartha.pages.dev

401k Max Contribution 2025 Catch Up Amara Vivien, So, these taxpayers can still contribute an additional $7,500 in 2025 ($31,000 total).

Source: harrieblebbie.pages.dev

Source: harrieblebbie.pages.dev

Max 2025 401k Contribution Emmey Iormina, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution.

Source: michaelbailey.pages.dev

Source: michaelbailey.pages.dev

Irs 401k Limit 2025 Catch Up Michael Bailey, In 2025, the total contribution limit is projected to be $71,000.

Source: cyndievcornelia.pages.dev

Source: cyndievcornelia.pages.dev

Irs 401k Catch Up Contribution Limits 2025 Tiff Adelina, In 2025, the total contribution limit is projected to be $71,000.

Source: isobelhjklorine.pages.dev

Source: isobelhjklorine.pages.dev

Irs 2025 401k Contribution Limits Catch Up Audi Marena, But, for individuals ages 60.

Source: bibiasesusette.pages.dev

Source: bibiasesusette.pages.dev

401k 2025 Contribution Limit Irs Over 60 Myrle Vallie, 401(k) contribution limits for 2025 the 401(k) contribution limit for 2025 is $23,500 for employee salary deferrals, and $70,000 for the combined employee and employer.

Source: michaelbailey.pages.dev

Source: michaelbailey.pages.dev

Irs 401k Limit 2025 Catch Up Michael Bailey, However, individual retirement account (ira) contributions will continue to be $7,000 in 2025, the same as in 2024.

Posted in 2025