Ctc 2024 Congress

Child tax credit expansion stuck in congress as deadline looms. Us congressional negotiators are nearing a bipartisan deal to renew expired business tax breaks and boost the child tax credit in time for many voters to receive the benefit during the current.

Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025. Should congress pass the tax package and biden sign it by jan.

Senior Lawmakers In Congress Announced A Bipartisan Deal Tuesday To Expand The Child Tax Credit And Provide A Series Of Tax Breaks For Businesses.

While there’s bipartisan support for the child tax credit, the road divides at work requirements.

The Tax Relief For American Families And Workers Act Of 2024 Expands The Ctc Over The Next Three Years So That More Families With Low Incomes — Including Those With Multiple Children — Can Access The Full Credit Amount.

Lok sabha elections 2024 live updates:

Images References :

Source: www.ctcd.edu

Source: www.ctcd.edu

Central Texas College For Students Of The Real World, The house on wednesday passed a roughly $78 billion tax bill that contains provisions making changes to restrict the employee retention credit (erc), expand eligibility for the child tax credit (ctc), and temporarily reinstate the expensing of research or experimental (r&e) expenditures. While there’s bipartisan support for the child tax credit, the road divides at work requirements.

![[2024 New Year’s Message] Fullscale Launch of CTC 5.0 (January 4, 2024](https://www.ctc-g.co.jp/common/image/ogp.png) Source: www.ctc-g.co.jp

Source: www.ctc-g.co.jp

[2024 New Year’s Message] Fullscale Launch of CTC 5.0 (January 4, 2024, More than 46 million taxpayers claim the child tax credit (ctc) each year, and recent temporary expansions have sparked debate in congress about the credit’s future. The irs is urging taxpayers not to wait to file their 2023 tax returns in anticipation that congress could pass the expanded child tax credit.

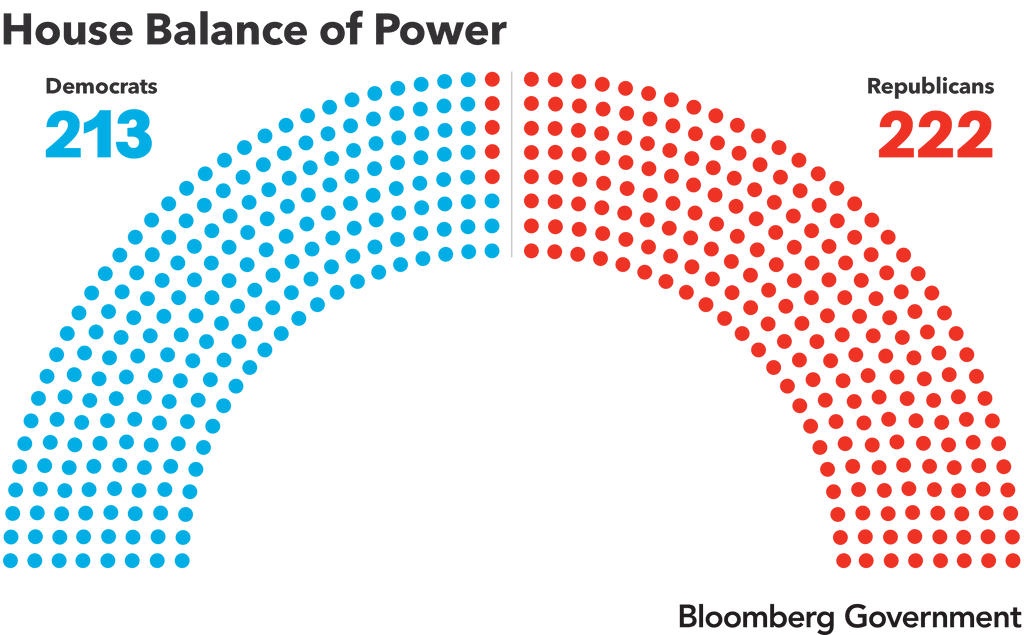

Source: about.bgov.com

Source: about.bgov.com

Congressional Balance of Power Republican Majority the House, Us congressional negotiators are nearing a bipartisan deal to renew expired business tax breaks and boost the child tax credit in time for many voters to receive the benefit during the current. Heading into the 2024 election, democrats want to resurrect a version of the child tax credit, which expired last year, to lower childhood poverty and give their vulnerable members a tangible policy win.

Source: www.brumidigroup.com

Source: www.brumidigroup.com

2023 House & Senate Calendar, Congress is already considering legislation that would mark a first step for biden’s agenda. Washington — the house voted wednesday night to pass a $78 billion tax package that includes an expansion of the child tax credit, sending it to the senate, where its path is uncertain.

Source: www.facebook.com

Source: www.facebook.com

ACPT Congress 2023, Should congress pass the tax package and biden sign it by jan. More than 46 million taxpayers claim the child tax credit (ctc) each year, and recent temporary expansions have sparked debate in congress about the credit’s future.

Source: www.europsy.net

Source: www.europsy.net

EPA 2024 Congress European Psychiatric Association, Child tax credit expansion stuck in congress as deadline looms. What else would change with the.

Source: itcgreece.gr

Source: itcgreece.gr

Εγγραφές ITC 2024 7ο Συνέδριο Υποδομών & Μεταφορών, Washington — the house voted wednesday night to pass a $78 billion tax package that includes an expansion of the child tax credit, sending it to the senate, where its path is uncertain. Highlights on june 8, 2024 foreign leaders begin arriving in delhi;

Source: www.iac2024.org

Source: www.iac2024.org

Congress venue IAC2024, In late january, the u.s. The irs is issuing $8,700 stimulus checks to qualifying americans in 2024.

Source: admin.itprice.com

Source: admin.itprice.com

Acia Conference 2023 2023 Calendar, “negotiators inch closer to a child tax credit deal,” reads a headline at semafor. The agreement would make it easier for more families to qualify for the child tax credit, as well as to get more money back in their annual tax.

Source: mcmcongress.com

Source: mcmcongress.com

MCM 2024 Program, Washington — congressional leaders are closing in on a $70 billion bipartisan and bicameral deal that would expand the child tax credit and provide tax. At the beginning of 2024, the u.s.

The Irs Is Issuing $8,700 Stimulus Checks To Qualifying Americans In 2024.

Congress is nearing a deal to partially restore an expansion of the child tax credit, which expired in 2021, in exchange for extending some corporate tax provisions.

Us Congressional Negotiators Are Nearing A Bipartisan Deal To Renew Expired Business Tax Breaks And Boost The Child Tax Credit In Time For Many Voters To Receive The Benefit During The Current.

The bipartisan agreement between the house and.

Category: 2024